Financial Services & Banking Critical Infrastructure

That faces various challenges, objectives, requirements, ethical considerations, cybersecurity threats, governance and risk management aspects, regulatory compliance, and regulatory requirements.

Ethics

Ethical considerations in the Financial Services & Banking sector may include:

- Integrity and fairness in financial transactions and dealings with customers.

- Transparency and disclosure of fees, terms, and conditions.

- Protecting customer privacy and respecting confidentiality.

- Promoting financial inclusion and responsible lending practices.

- Code of conducting business ethically and in compliance with the law everywhere we operate. No one should ever sacrifice integrity.

GRC Alignment

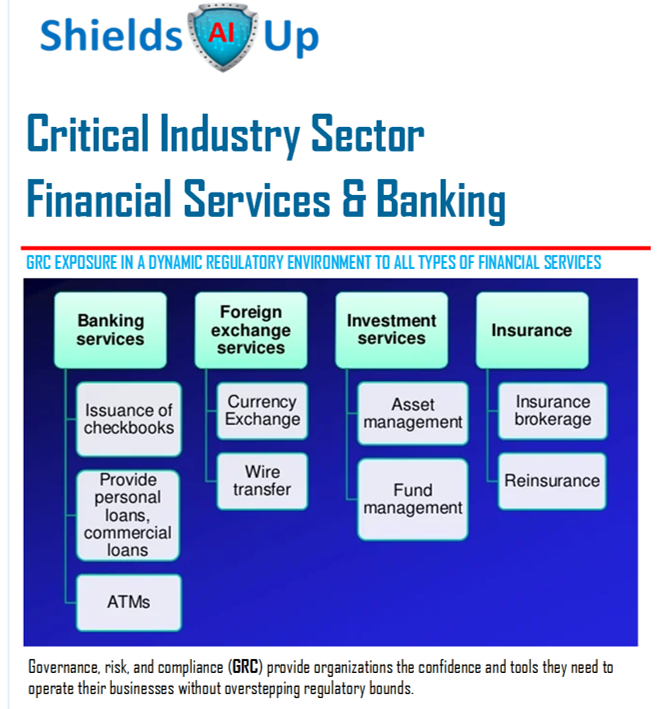

Governance, risk, and compliance (GRC) provide organizations the confidence and tools they need to operate their businesses without overstepping regulatory bounds.

To address these challenges, objectives, requirements, ethics, cybersecurity threats, governance, risk management, regulatory compliance, and regulatory requirements requires ongoing collaboration among financial institutions, regulatory authorities, and industry stakeholders.

Organizations develop a GRC framework for the leadership, organization and operation of the organization’s IT areas to ensure that they support and enable the organization’s strategic objectives. The framework specifies clearly defined measurables that shine a light on the effectiveness of an organization’s GRC efforts.

Involves vulnerabilities in the Financial & Banking Services Critical Industry Sector that can expose institutions and their customers to various risks.

Vulnerabilities That Exist In This Sector

Financial Services & Banking are 300 times more likely to be the victim of a cyberattack than other organizations . Organizations in the finance sector are highly concerned about cyber threats. Federal Reserve Chairman Jerome Powell warned last year that cyberattacks are the No. 1 threat to the global financial system. Cap Gemini’s Top Trends in Banking 2022 declared cybersecurity is becoming a competitive differentiator for banks.

Critical Success Factor (CSF) Questions

These questions serve as a starting point for discovering critical success factors, but it’s important to customize them based on the specific context and objectives of the organization.

Conducting in-depth analysis, engaging stakeholders, and leveraging industry expertise can further refine the identification of critical success factors.

Understand Value

Understanding the value proposition helps identify critical success factors that contribute to creating and delivering value to customers or stakeholders.

By asking these discovery questions and engaging relevant stakeholders, organizations can identify the critical success factors specific to their context and develop strategies to focus on those factors for achieving their objectives effectively.

View all Angles

Vulnerabilities require a multi-faceted approach because they often stem from a combination of factors and can impact various aspects of an organization. A multi-faceted approach ensures that vulnerabilities are addressed comprehensively and from different angles.

Overall, a multi-faceted approach recognizes the interconnected and multifaceted nature of vulnerabilities. By employing a comprehensive range of strategies, organizations can effectively mitigate risks, protect their assets and stakeholders, and enhance their overall resilience in the face of vulnerabilities.

Multi-faceted Look

Let’s sit down with Shields🛡️Up to address these vulnerabilities and implement your appropriate safeguards, financial institutions can strengthen their security posture, protect customer data, and maintain the trust and confidence of their customers.